The Magnificent Seven includes some of the most innovative tech-orientated companies on the market. But what if there was a Magnificent Seven for dividend stocks?

Microsoft (NASDAQ: MSFT), Coca-Cola (NYSE: KO), Procter & Gamble (NYSE: PG), Chevron (NYSE: CVX), Home Depot (NYSE: HD), JPMorgan Chase (NYSE: JPM), and United Parcel Service (NYSE: UPS) represent their industries well and are all top dividend stocks you can count on for decades to come. Here's why they would make my list for the Magnificent Seven of dividend stocks.

1. Microsoft

Microsoft is the only Magnificent Seven stock that also deserves to be in the Magnificent Seven of dividend stocks. It is the most valuable company in the world. Microsoft only yields 0.7%, but it pays the most dividends of any U.S.-based company.

Microsoft's low yield is due to its outperforming stock price, not a lack of commitment to dividend raises. Since fiscal 2019, Microsoft has raised its dividend by 9% to 11% every year like clockwork. The dividend has doubled over the last eight years -- a faster growth rate than many of the market's top dividend stocks.

Microsoft is monetizing artificial intelligence and growing its earnings, paving the way for plenty of future dividend raises. If the stock price languishes, the dividend yield will rise to a much more attractive level. However, Microsoft shareholders would surely prefer outsized gains over a higher dividend yield.

2. Coca-Cola

co*ke uses its dividend as the primary way to reward faithful shareholders. With a yield of 3.2%, co*ke allows investors to collect passive income from a tried and true Dividend King with 62 consecutive annual dividend increases.

co*ke is a low-growth business, so investors shouldn't expect outsized gains from the stock. But this is the Magnificent Seven of dividend stocks, not growth stocks. And when it comes to generating passive income, co*ke is as reliable as it gets.

co*ke's consistency is the core reason why Warren Buffett's Berkshire Hathaway has held the stock for over 30 years.

If it were a decision between co*ke and a 10-year Treasury, I'd take co*ke all day. The 10-year gives investors another percentage point or so in yield, but with no participation in the market. Of course, no stock is as safe as the risk-free rate, but co*ke is close. It's the ideal investment for risk-averse investors or anyone looking to supplement income in retirement.

3. Procter & Gamble

Procter & Gamble has a massive capital return program. It is a great example of a company using dividends and stock repurchases to reward shareholders.

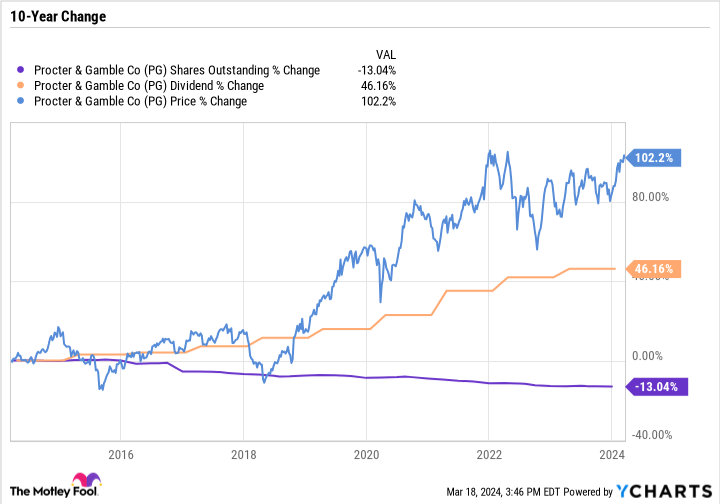

The following chart is one of the prettiest you'll ever see from a stodgy consumer staple company.

P&G stock has more than doubled over the last decade, the dividend is up over 46%, and P&G has repurchased a considerable amount of stock, reducing its share count by 13%.

P&G may not be the most exciting business, but glitz and glam isn't the point of this list. When it comes to rewarding shareholders, P&G has done it in many ways and has the business model and brand power needed to continue that streak going forward.

4. Chevron

Chevron's stock buybacks aren't nearly as consistent as P&G's. The oil giant tends to buy back more stock during an uptick in the business cycle and pull back on repurchases and capital spending when oil and gas prices fall.

But Chevron's dividends are as consistent as they come. Chevron has raised its dividend for 37 consecutive years. That means it didn't cut it during the COVID-19-induced crash, the 2014 and 2015 downturn, or any oil and gas downturn since the late 1980s.

Chevron has the balance sheet, cost profile, and portfolio to continue rewarding shareholders. Its dividend yield of 4.2% makes it one of the higher-yielding reliable stocks out there.

5. Home Depot

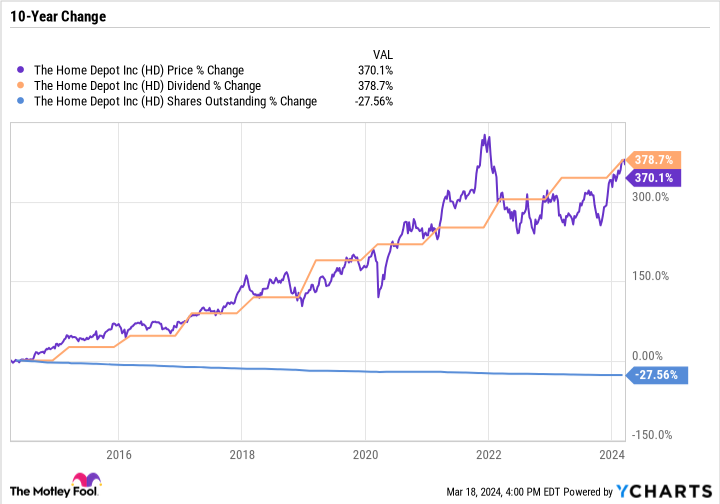

Home Depot has been a perfect dividend stock over the last decade. It has crushed the broader market, and somehow, the dividend has grown at an ever faster rate.

Home Depot has also reduced its share count by over a fourth while expanding the business.

Investors shouldn't expect this level of growth over the next 10 years, but Home Depot is still a good investment. The company is vulnerable to external factors, such as broader economic cycles, the housing market, the construction industry, and consumer spending. But it is well positioned, and one of the best cyclical dividend stocks to own long term.

6. JPMorgan Chase

Since Nov. 1, JPMorgan is up over 38% -- a massive move for such a large, diversified bank. JPMorgan is now worth more than Bank of America, Wells Fargo, and half of Citigroup combined. The Big Four banks have really turned into JPMorgan and the other three.

Banking is a cyclical industry that tends to ebb and flow to the tune of the broader economy. Right now, JPMorgan's profits are soaring.

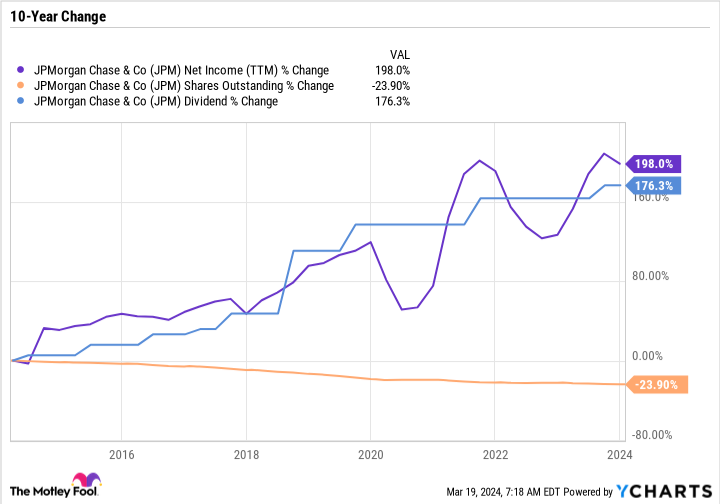

Still, what makes the company a good long-term investment, and a worthy addition to the Magnificent Seven of dividend stocks, is that it regularly returns value to its shareholders. Over the last decade, the dividend is up 176%, while the share count is down nearly a fourth.

JPMorgan slashed most of its dividend in 2009 during the fallout of the financial crisis. But since then, it has raised its dividend every year. Today, the dividend is nearly triple what it was pre-cut, and JPMorgan has turned into a quality passive income play.

The recent run-up in the stock price has pushed JPMorgan's yield down to 2.2%. But the company is at the top of its game and is a good representative of the financials sector in the Magnificent Seven of dividend stocks.

7. UPS

UPS has raised its dividend every year for the last 21 years, except for in 2009, when it kept its dividend flat. The company isn't the most reliable dividend payer on this list, but it has increasingly used dividends as a key way to reward shareholders.

In 2022, UPS raised its dividend by 49%, a significant increase for its size. Today, UPS yields 4.3%, which is high for an industry-leading industrial company.

UPS is a cyclical business that depends on the strength of the broader economy. Package delivery volumes to businesses are higher during an economic expansion. Similarly, deliveries to consumers are higher when discretionary spending is strong.

Although UPS offers investors a compelling yield, it's doubtful the company will make as large of raises to its dividend going forward. Still, its current level is quite high, as UPS stock would have to rally about 45% for the yield to fall below 3%.

Different companies, similar investments

Microsoft, Coca-Cola, Procter & Gamble, Chevron, Home Depot, JPMorgan Chase, and UPS have track records of dividend raises, solid underlying businesses, future growth prospects, and industry leadership. Many of these companies also reward shareholders with stock repurchases, as well as long-term capital gains for patient investors.

These companies may not always have the highest yields, but they do have earnings growth, which sets the stage for future raises.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for two decades, Motley Fool Stock Advisor, hasmore than tripledthe market.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and Microsoft made the list -- but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of March 21, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Wells Fargo is an advertising partner of The Ascent, a Motley Fool company. JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Citigroup is an advertising partner of The Ascent, a Motley Fool company. Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bank of America, Berkshire Hathaway, Chevron, Home Depot, JPMorgan Chase, and Microsoft. The Motley Fool recommends United Parcel Service and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

If There Was a "Magnificent Seven" for Dividend Stocks, These Would Be My Top Picks was originally published by The Motley Fool